Accounts Payable Specialist: Elevating Financial Operations Without Overblown Costs

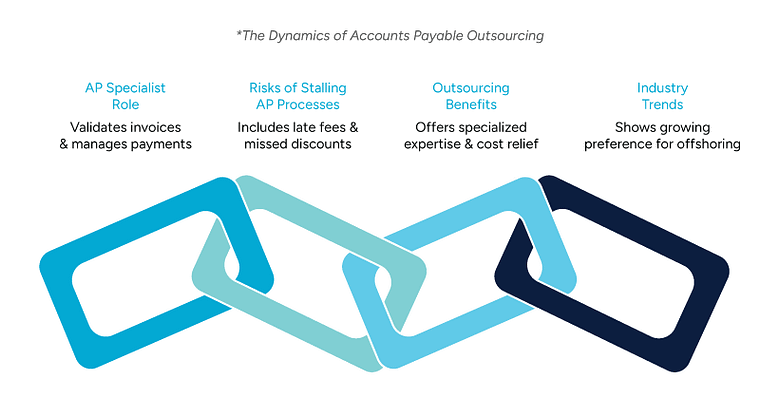

Accounts Payable (AP) is a core component of any finance function. When an AP process stalls, due to manual data entry, slow approvals, or overlooked invoices, businesses face late-payment fees, missed vendor discounts, and potential fraud.

These risks are especially significant for companies expanding operations or aiming to keep overhead under control. An AP Specialist addresses these challenges by validating invoices, managing vendor payments, and mitigating compliance risks.

Industry trends show a growing preference for offshoring and outsourcing AP roles. Many small and midsize businesses are moving accounts payable tasks offsite to tap into specialized expertise, advanced tools, and significant cost relief.

According to multiple sources, including the US Chamber of Commerce, outsourcing accounts payable can help free leadership to focus on business development instead of day-to-day transaction processing.

What is Accounts Payable Offshoring & Outsourcing?

Offshoring an AP role means hiring a dedicated specialist from an offshore talent pool to work within your company’s existing systems. The AP Specialist integrates with your team, managing invoice processing, payments, and vendor relations while following internal controls.

Outsourcing AP functions delegates the entire process, including invoice handling, payment scheduling, and compliance, to an external provider. The provider handles AP tasks remotely, typically using their own systems and automation tools.

Organizations benefit from either model, depending on whether they prefer to retain in-house oversight or fully transfer operational responsibilities. Common services include:

Businesses that offshore AP roles maintain direct control over financial workflows while reducing costs. Companies that outsource AP functions eliminate internal administrative burdens while improving efficiency and compliance.

How Accounts Payable Offshoring or Outsourcing Works

Most AP outsourcing or offshoring providers follow a structured transition process:

1. Onboarding & Data Migration

A thorough review of AP expectations takes place to clarify payment terms, software usage, and compliance needs. Once defined, financial data migrates to a secure system, either within the client’s existing platform or the provider’s proprietary AP software.

2. Invoice Processing & Validation

Invoices arrive in multiple formats (electronic, paper). The AP provider or offshore specialist verifies each invoice against the corresponding purchase order. Proper validation prevents overpayments, duplicate invoices, and unauthorized charges.

3. Approval Workflow

Approved invoices move to a designated reviewer for final sign-off. If discrepancies arise, the AP team revises and re-submits for approval, ensuring all documentation is accurate.

4. Payment Processing

Vendor payments are scheduled based on pre-defined rules, optimizing cash flow and maximizing early-payment discounts. Offshore AP specialists or outsourcing partners handle multi-currency payments, reducing foreign transaction complexities.

5. Vendor Management

Dedicated AP professionals manage supplier relationships, resolve billing issues, and track payment histories. This approach prevents late fees, improves vendor trust, and reduces unnecessary follow-ups.

6. Compliance & Reporting

Outsourced AP providers generate regular reports on financial obligations, tax documentation, and risk exposure. Offshore AP specialists ensure internal reporting accuracy, keeping finance teams updated on liabilities.

The Advantages of Offshoring or Outsourcing Accounts Payable

1. Cost Reduction & Scalability

Hiring an in-house AP team means managing salaries, benefits, software licenses, and infrastructure. Offshoring an AP Specialist reduces these expenses by 30-70%, depending on the region. Outsourcing AP processes provides predictable, subscription-based pricing, eliminating HR and recruitment costs.

2. Faster Invoice Processing & Fewer Errors

AP automation and optical character recognition (OCR) speed up invoice matching, reducing manual data entry errors. Companies using offshore or outsourced AP services see fewer missed payments and stronger vendor relationships.

3. Improved Cash Flow & Liquidity

A well-managed AP function ensures payments are on time, optimizing working capital. Companies that outsource AP functions gain real-time financial dashboards, making it easier to project short-term liabilities.

4. 24/7 AP Operations Across Time Zones

Offshore AP specialists provide round-the-clock invoice processing and payment approvals, reducing backlogs caused by staff absences. Outsourced providers often offer 24/7 vendor support, addressing inquiries faster than internal teams.

5. Fraud Prevention & Regulatory Compliance

Fraudulent invoices, duplicate payments, and unauthorized transactions are costly. Offshore AP professionals undergo strict fraud prevention training, and outsourcing providers integrate AI-based fraud detection tools to flag suspicious activity.

What Does Accounts Payable Outsourcing Typically Include?

Financial Accuracy and Compliance Gains

Outsourced AP often draws on specialized knowledge. This mitigates the risk of penalties arising from incorrect entries or overlooked local regulations. Some providers incorporate:

Optical Character Recognition (OCR) for invoice extraction

Automated workflows to schedule approvals and payments

Real-time reconciliation tools to maintain up-to-date financial records

Regular audits, advanced error-tracking systems, and compliance checks align AP processes with accounting standards. Additionally, the right partner incorporates strict user-permission rules that thwart fraud or misuse. The typical organization, according to the Association of Certified Fraud Examiners, loses around 5% of revenue to fraud. Proactive approaches such as duty segregation and fraud-detection software directly lower these odds.

Cost Efficiency and Resource Optimization

Maintaining an internal AP team involves salaries, benefits, annual training, and management overhead. In contrast, outsourced AP arrangements use predictable, subscription-based costs. By delegating routine finance operations, leaders reassign local staff to strategic roles. This fosters more robust marketing campaigns, product launches, or client services.

Why Outsource Your Accounting?

It is difficult to supervise every aspect of a company without specialized support. Accounting experts help business owners avoid costly mistakes and keep financial systems ready for external audits.

Many small businesses assume they cannot afford accounting or AP outsourcing. However, the long-term savings often exceed the monthly service fees, especially when factoring in missed penalties and better vendor terms.

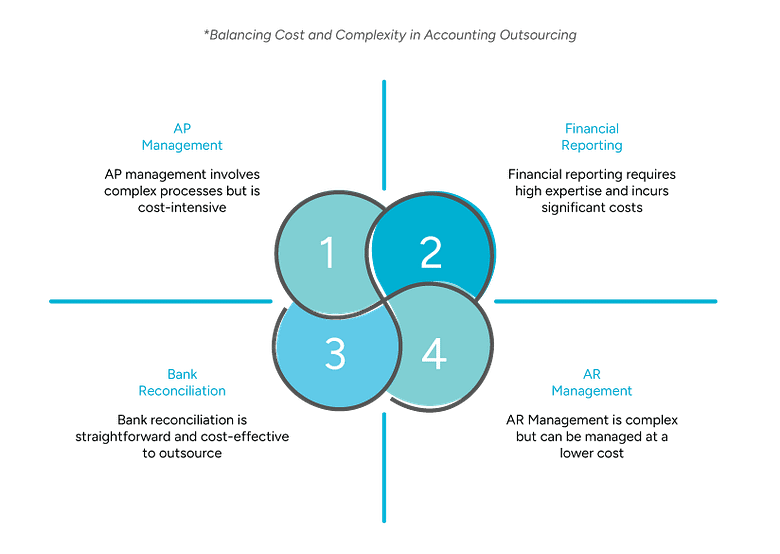

Some typical tasks an outsourced accounting service handles include AP and AR (accounts receivable) management, bank reconciliation, and financial reporting. These daily accounting routines free up the business owner’s or COO’s time to concentrate on scaling the enterprise.

As stated by multiple experts, delegating bookkeeping cuts down the tedium and potential error inherent in manual data entry.

Growing Demand for AP Outsourcing

Companies across sectors, especially smaller businesses in the US, are discovering that in-house AP management strains employees and budgets as they increase transaction volumes. AP outsourcing is about partnership, not loss of control, since the client maintains final approvals and oversight.

Many organizations experience these issues before realizing the need for offshoring or outsourcing AP roles. NetSuite highlights how delayed AP processes damage supplier relationships, affecting long-term contract negotiations.

LevelUp as a Dedicated Accounts Payable Offshoring & Outsourcing Partner

Businesses seeking a straightforward path to cost savings, process optimization, and financial clarity can explore an offshore AP Specialist through LevelUp.

LevelUp connects companies with skilled professionals experienced in invoice validation, vendor management, payment scheduling, and real-time reporting—delivering expertise without the high costs of local hiring. With contracts, onboarding, and compliance handled, decision-makers can focus on strategic growth rather than daily invoice management.

Book a consultation with LevelUp to find the right remote Accounts Payable Specialist for your business.

Skilled professionals, clear cost structures, and flexible engagements help companies maintain a stable financial position, all while avoiding the pitfalls tied to traditional hiring models.